The dairy industry is entering an unprecedented period of transformation. Rising health awareness and growing demand for personalization are driving the shift from traditional staples toward more functional, nutritious, and specialized dairy products. Globally, demand for high-protein, probiotic, and tailored solutions targeting specific groups—such as children, seniors, and athletes—is accelerating. Meanwhile, technological innovation and digital tools are reshaping product development, supply chain management, and consumer experience. They enable companies to gain precise insights into consumer needs, accelerate product iteration, and achieve efficient engagement through digital channels.

How can the dairy industry, under the dual drivers of nutritional upgrading and technological empowerment, seize new opportunities, foster product innovation, strengthen brand differentiation, and achieve sustainable growth?

Food science is evolving from lab discovery to large-scale impact. As consumers seek evidence-based and personalized health solutions, the challenge is to make science both accessible and actionable.

Danone is meeting this challenge through initiatives such as OneBiome, precision fermentation partnerships, digital nutrition platforms, and sustainability-driven R&D. By scaling microbiome and nutritional science globally, Danone is redefining what it means to connect science, health, and everyday life.

Driven by consumption upgrades and growing health demands, the dairy industry is shifting from simply “filling up” to truly “eating well,” with nutrient density emerging as a new benchmark for dairy value. Nutrient density encompasses not only the content and bioavailability of core nutrients such as protein, calcium, and vitamins, but also extends to formula optimization, ingredient upgrading, and precision nutrition solutions for different consumer groups. As a global leader in dairy and nutritional science, Nestlé has made “nutrient density” a strategic priority for 2024, aiming to deliver higher nutritional value across its product portfolio within limited calories, while maintaining taste and sustainability.

This session will explore how nutritional density can drive a leap in dairy product performance—from scientific research to formulation to consumer education—offering actionable insights for the industry.

From human milk oligosaccharides (HMOs) to functional probiotics, from novel cheese structure design to AI-driven formulation development, Yili Innovation Center Europe has spent the past decade advancing its vision of “driving industry through science, serving health through technology.” The center has achieved a series of influential breakthroughs across multiple frontiers of nutrition and technology. This journey is not only a real-world exploration of integrating scientific research with dairy innovation, but also a valuable model of cross-border R&D collaboration for dairy companies in China and around the world—demonstrating how science, industry, and consumers can form a positive cycle to build an innovation ecosystem for the future.

Chilled dairy has become one of the most dynamic arenas for product innovation. Consumers now seek not only core nutrition but also functional alignment with active lifestyles and delightful consumption experiences across various moments.

This session explores how to build the next generation of chilled dairy innovation through the synergy of:

-Nutrition enhancement as category foundation

-Functional differentiation to unlock new growth territories

-Experience-driven scenarios from daily nourishment to better-for-you indulgence

-A structured innovation model that sustains category momentum

A practical deep dive into how brands can lead future growth by optimizing across nutrition × function × experience.

As consumers’ perception of dairy quality continues to rise, “great taste” is becoming a key differentiator in the chilled milk segment. From smooth texture and clean aftertaste to the absence of unwanted dairy notes or excessive heaviness, consumer expectations for milk’s sensory profile are becoming increasingly refined and demanding. In the chilled milk market, high protein, A2 milk, organic sourcing, and added flavors have become common strategies. Yet true innovation that addresses product pain points through process breakthroughs remains rare. Meiji’s “Oishii (Exquisite Taste) Milk” is one such pioneer. Taste is no longer just a “natural outcome,” but a consumer experience that can be defined and perfected through technology.

“Sour” was once a simple taste of everyday life, but under Classykiss’s hands, it has been transformed into a strikingly modern flavor experience. From Pink Guava Lemon Peach to Yellow Apricot Yellow Peach Plum, Classykiss’s “Sour Series” draws inspiration from regional cultures and local sour notes, skillfully blending salty, sour, fruity, and creamy dairy flavors. This bold approach pushes product innovation beyond conventions while maintaining the brand’s signature premium quality and attention to detail.

Amid the prevailing consumer trends of “health × taste × emotional value,” Classykiss is redefining what “premium” means with its sour yogurt—not as something expensive, but as a taste rich with story, detail, and culture.

Flavor innovation in yogurt is moving beyond “sweet and fruity” toward bolder and more cross-category experiments. Beyond the craze for local fruits such as guava and passion fruit, vegetable-flavored yogurts are quietly emerging—kale, beetroot, and even bitter melon are becoming new favorites on the ingredient list. This not only challenges consumers’ palates but also helps yogurt transcend its role as a “snack,” bridging into the realms of “light meals” and “functional dining.”

(Image source: Pexels)

Semaglutide has once again claimed the top spot in global pharmaceutical sales for the second quarter. GLP-1 drugs are reshaping consumers’ understanding of “weight management” and “metabolic health,” while also driving the food industry to shift from appetite stimulation toward precision nutritional support. As a major source of natural protein and micronutrients, will dairy be sidelined by the “appetite-suppressing” trend, or could it pivot to become a key provider of nutritional support for GLP-1 users?

In this “lifestyle revolution” triggered by pharmaceuticals, dairy brands may face challenges—but they could also be among the first categories to rebuild consumer trust and perceived value.

Amid the global protein boom, Danone’s Oikos brand has successfully emerged as one of the most representative high-protein yogurts in the North American market. In 2024, Oikos’ retail sales surged 40%, surpassing USD 1 billion in annual revenue for the first time. Through precise market positioning, dual optimization of taste and nutrition, and engaging, lifestyle-oriented brand communication, Oikos has not only won over the sports and fitness community but also made its way onto everyday family tables—becoming a star example of dairy functional upgrade.

How has Danone transformed a traditional dairy subcategory into a “high-protein daily nutrition solution” for the mass consumer?

GLP-1 therapies are not just changing how people lose weight — they are reshaping the entire weight management ecosystem. From shifting consumer behavior to redefining the role of nutrition, the implications reach far beyond medication.

In this keynote, Nestlé Health Science offers a strategic perspective on how a global nutrition leader is rethinking its role in the GLP-1 era: where nutrition adds unique value alongside pharmacological treatment, how portfolios and evidence strategies are evolving, and what the next phase of weight management will demand from food and nutrition companies worldwide.

GLP-1 drugs are sweeping the globe, reshaping the weight management landscape.

Yet as questions around efficacy, side effects, cost, and accessibility emerge, growing attention is shifting to the “post-GLP-1 era.” Diverse approaches—ranging from nutritional interventions and functional foods to metabolic health formulations—are entering the field.

What structural changes has the GLP-1 boom already triggered? And as the market normalizes or cools, where will the next wave of innovation and business opportunities in weight management arise? Where are the advantages and opportunities for dairy enterprises?

According to NIQ data, against the backdrop of a slowing overall dairy market, total dairy sales across all channels in Q1 2025 fell by 6.9%, indicating mounting market pressure. To achieve breakthrough growth, companies must focus on both product innovation and channel strategy. New product development, functional dairy, and differentiated offerings have become key drivers for attracting consumers, while emerging online channels are performing exceptionally—content-driven e-commerce, for example, grew by 35.1%, highlighting how social and digital channels are rapidly reshaping dairy sales.

This session will explore how the deep integration of product innovation and new channel strategies can stimulate consumer demand, enhance brand influence, and identify best practices for dairy companies seeking growth in the era of digital transformation.

Against the backdrop of fierce competition between ice cream and freshly made dairy brands in China, and rapidly shifting consumer preferences, DQ has continued to deliver stable and resilient growth. In 2025, with a network of more than 1,800 stores, DQ launched over 150 new products. These new offerings accounted for more than 60% of total annual sales, while average sales per store increased by over 11% year on year.

Behind this performance is not a reliance on a single blockbuster product or short-term marketing campaigns, but a highly focused, well-paced, and long-term-oriented product strategy.

In mature markets such as Europe, the U.S., and Australia, Kefir is rapidly moving from a niche beverage to mainstream popularity, thanks to its diverse microbial strains, gut health benefits, and natural fermentation properties. According to IMARC Group, the global Kefir market is projected to grow from USD 2.155 billion in 2024 to USD 3.679 billion by 2033, at a compound annual growth rate of 5.81%.

UK brand Bio-tiful has captured approximately 70% of the local market with its high-activity strains and health-focused positioning, posting a 646% profit increase in FY2024, becoming a leading example of the Kefir category’s rise.

Meanwhile, Chinese consumers are increasingly attentive to factors such as “strain count” and “functional benefits,” driving demand for functional dairy products. Kefir, originating from the Caucasus, may offer a promising breakthrough as a functional dairy innovation for the Chinese market.

(Image source: Bio-tiful)

In the highly competitive and seasonal ice cream market, Pobeice has carved out a distinctive growth path. Since its founding in 2020, the brand has quickly expanded from a regional player to a national presence across over 150 cities and 1,150+ stores. Leveraging a combination of “freshly made products + hit items + visually appealing designs,” it has stood out among young consumers.

Amidst a market characterized by price wars, innovation races, and visual competition, how has Pobeice managed to break through and differentiate itself in the freshly made ice cream segment?

AI is reinventing every beverage link—concept, flavor, production, channel, consumer. PepsiCo rolls out Salesforce Agentforce, embedding autonomous AI agents. ChaPanda's "AI + DevOps" model uses LLMs to lift R&D efficiency by 24%. Live cases fuel a practical Beverage AI Transformation White Paper that merges trends with step-by-step guidance.

Store expansion typically comes at the expense of efficiency and cash flow. Yet in China’s highly competitive coffee market, NOWWA’s joint-operation model is challenging this assumption.

By 2025, NOWWA surpassed 10,000 stores, adding around 1,000 locations per month (peaking at 1,800), while delivering 4× year-on-year GMV growth and 3× cup volume growth, indicating scale without value dilution. The model has also proven resilient under stress, with a nationwide campaign driving 458% order growth and over 600% in multiple regions, while systems and supply chains remained stable.

This session will unpack how NOWWA sustains efficiency and cash flow at scale through a lightweight store model, full-day operations, integrated supply chains, and a delivery- and digital-first approach.

Many growth challenges in the beverage industry do not come from weak products, but from applying the same product assumptions to very different demand contexts.

In mature markets, beverages drive growth through functional substitution and new consumption occasions. In growth-stage markets, the priority is establishing everyday consumption, requiring R&D to focus on cost, flavor universality, stability, and scalability.

This means the same beverage represents different businesses at different market stages, shaped less by formulation than by demand maturity, consumption frequency, and channel context. Understanding how demand evolves across city tiers, channels, and category stages is critical for effective R&D decisions.

From an R&D perspective, for the herbal plant-based beverage category to break through formula homogenization and weakly perceived functionality, innovation must go beyond ingredient combinations. It requires not only the use of authentic ingredients and differentiated, often rarer herbal sources at the raw-material level, but also the reinforcement of functional efficacy through the integration of process design and formulation science.

LOLO Herbal range follows this pathway. Guided by the principle of medicinal–food homology, the brand combines traditional slow-simmering techniques with a clean-label formulation strategy—low sugar, zero artificial flavorings, and no added additives. By emphasizing real ingredients and clean formulations, LOLO Herbal establishes differentiation while aligning with the low-sugar trend. Leveraging its existing channels and organizational capabilities, the brand continues to expand distribution, while strengthening its online presence through packaging and format innovation.

Looking ahead, growth in the herbal plant-based beverage category may shift from a competition over “who is healthier” to one centered on precision, verifiable efficacy, and drinkability.

IWSR projects global low- and no-alcohol beverage sales will grow by $4 B by 2028. Suntory leads innovation with its ALL-FREE line, using plant extracts to build layered taste and "everyday drinkable" appeal. Asahi Zero surpassed 600,000 cases in 2024, doubling output to meet rising demand. De Soi, a French-style non-alcoholic sparkling brand, uses botanicals to offer a "lightly tipsy" experience. No-alcohol drinks are evolving beyond substitutes, establishing a "fourth occasion" between tea, soft drinks, and alcohol through plant extracts and natural fermentation.

(Image source: Suntory)

In the Starbucks-and-Luckin price-speed race, Peet's Coffee takes a measured approach. Skipping low-price promos and gimmicky menus, it builds trust with hand-brewed coffee from beans roasted within 21 days. In China, its "less-but-better" line, small-batch roasting, and in-store experiences drove double-digit 2024 sales growth and a 23.8% organic EBIT increase—proving growth beyond price wars and scale is possible.

Freshippo's Turmeric, Ginger & Lemon Juice shot has gone viral, with its 100 ml concentrated formula attracting more than 2,000 repeat monthly buyers and topping the refrigerated-drink repurchase charts. In the UK, MOJU leveraged HPP for functional juices, reaching £20 million in 2023 with 71% year-on-year growth and a 62% market share. In 2025, Suntory's GINGER SHOT+ combined 100% concentrated juice with premium ginger for both sensory impact and daily wellness benefits.What drives the success of "shot-style functional drinks"?

The new generation of consumers demands more from "drinking water": it must hydrate while delighting the senses, be guilt-free yet full of flavor. KDP's Stur leverages a "zero sugar + real fruit extract" proposition to secure a leading position in the "natural water enhancer" segment. Meanwhile, Waterdrop innovates through flavor, offering 25 flavor cubes that transform drinking water from a basic necessity into a frequent, enjoyable ritual. How can flavored water deliver a rich sensory experience without compromising health? And how can flexible delivery formats promote more frequent, "on-the-go" hydration behaviors?

DFSY, after a two-year hiatus, launched its "Chenpi White Tea," combining premium white tea with aged tangerine peel to deliver a fresh and approachable flavor in a niche segment. Master Kong entered the segment with "Fresh Green Tea," leveraging low-temperature fresh-brewing techniques to enhance tea aroma. "Ripe Fruit" distinguished itself with a floral tea base and a smooth, naturally sweet profile, becoming the only top-five brand to achieve four consecutive quarters of growth.

This session will focus on flavor optimization and health functionality in unsweetened teas, exploring how brands can overcome the "low-sugar, bland taste" challenge and identify the next wave of growth within a mature market.

In 2023, HPP cold-pressed juice brands such as VCLEANSE achieved annual sales exceeding RMB 500 million. Meanwhile, Freshippo’s HPP red-fleshed apple juice saw a 400% year-on-year surge in 2024, and its newly launched HPP shot-sized products have frequently appeared on “sold-out” lists. As superfoods like turmeric, ginger, and spirulina trend, HPP is expanding beyond fruits and vegetables. The challenge: using this technology to balance function with flavor innovation.

Ice cup sales are booming, with Freshippo, Nongfu Spring, and Lawson joining the trend. By June 2025, coffee ice-cup sales rose 60% YoY, fueling a new "ice-cup-plus-beverage" wave in coffee and tea. Commercial ice uses slow-flow freezing and layered techniques to create dense, slow-melting ice. Durable cups and heat-shrink lids ensure stability at -18 °C to -20 °C. Korea's GS25 pioneered the format in 2021 with its 7 cm Big Ball ice cup. This session highlights innovations in ice making and how ice cups are reshaping beverage consumption.

Carbonated beverages remain a key battlefield in the beverage industry, as evidenced by Nongfu Spring's sparkling iced tea, Dayao's annual sales exceeding 3 billion units, and Pepsi's 100,000-ton expansion project. The challenge lies in seamlessly integrating complex multi-flavor profiles with carbonation while maintaining CO₂ stability and long-lasting effervescence in tea, juice, or dairy-based formulas.

The rapid rise of HPP (High Pressure Processing) beverages has drawn wide industry attention, but HPP faces limits such as long cycles, high energy use, and scalability issues. PEF (Pulsed Electric Field) offers a faster, more efficient alternative: by applying short, high-voltage pulses to juice flow, it instantly disrupts microbial membranes, enabling sterilization within microseconds and continuous production. Compared with HPP, PEF consumes less energy and better preserves juice color, aroma, and nutrients. This session examines PEF's principles, applications, and outlook, highlighting its promise and challenges for the juice sector.

As mass-market teas lose appeal, RTD innovation pivots to regional flavors. ChaPanda blends glutinous rice + soy milk in Southwest China; Good Me uses dried-tangerine oolong and rice-water bases in Fujian/Guangdong; Mixue Ice Tea's peanut-red-date-millet drinks hit Henan fields via "wheat field delivery"; Guizhou's Qu Cha Shan taps local crops, serving 400 cups/h; Heytea's "Inspiration Tea" spans Sichuan pepper Dianhong to Tibetan Plateau Litsea cubeba papaya. This session maps how "regionalized flavor" unlocks local markets and consumer love for ready-to-drink teas.

Across the global beverage industry, innovation is shifting from single-point breakthroughs to parallel validation of product concepts. Diverse consumer needs, processing technologies, and flavor systems are creating new growth opportunities—while placing higher demands on R&D and application design.

The FBIF2026 Concept Product Launch does not define a single challenge. Instead, it highlights four high-relevance innovation pathways, giving shortlisted participants the flexibility to choose the direction best aligned with their strengths and to present commercially applicable product concepts that respond to real market needs.

Four Innovation Pathways

1 | Sports Nutrition

As the sports nutrition market continues to expand, innovation is moving beyond powders and shakes toward RTD, daily-use, and low-burden beverages. This pathway focuses on proteins, amino acids, electrolytes, and functional blends, with emphasis on taste, stability, and usage scenarios.

2 | HPP & Cold-Pressed Technology

With growing demand for minimally processed products, HPP technology is gaining traction across juices, functional beverages, and premium RTDs. This pathway explores flavor retention, formulation stability, and differentiated expression under HPP processing.

3 | Coffee Ingredient & Application Innovation

Coffee is evolving into a broader ingredient system spanning flavor, functionality, and everyday occasions. This pathway highlights innovative uses of coffee ingredients in RTD, functional, low-burden, and cross-category applications.

4 | Flavor & Sensory Innovation

Flavor has become a key driver of emotional connection and consumption context. This pathway encourages distinctive flavors, regional profiles, and multi-sensory designs, exploring how flavor can define product identity and competitiveness.

From April 2023 to March 2025, global launches of snacks with health claims grew by 22% (Innova), with nuts and seeds leading the way. Heart health, energy support, and weight management are now the top three functional positions. As consumer demand evolves, the focus is shifting from single health claims to multi-functional, experience-driven products. This session explores opportunities and challenges in functional ingredient innovation, with insights from leading brands on formulation and consumer education.

By 2032, the global high-protein snack market is projected to exceed $58.7 billion. What began with protein bars has now expanded into bean-based snacks, meat jerky, and many other formats. While nutrition matters, taste is the ultimate challenge. How can brands strike the right balance between nutrition and deliciousness? In this session, we invite R&D leaders from top global protein snack companies for a “high-energy” dialogue, sharing their breakthroughs and revealing the secret to making protein truly tasty.

Food innovation is like a never-ending relay race. Traditional models often build on current assumptions, technologies, and business models to drive incremental progress. Mondelez believes true breakthroughs start by imagining the future. For leaders in the F&B industry, future-back thinking is especially critical as global forces reshape what, how, and why people consume. It helps companies anticipate change, align innovation with long-term shifts, and build resilience and growth in an uncertain world.

Clean label is shifting from an industry ideal to a real growth engine. According to Tmall's Healthy Snacks Trend Report, products that adopt clean label principles see a 20–50% increase in repurchase rates and a 15% rise in average order value. What consumer needs lie behind this surge? Where should companies begin? And how can brands win with clean label? This session explores clean label from insight to execution. Experts will unpack the real opportunities and practical pathways to help companies build cleaner, more credible products and capture the next wave of growth.

Traditional brewing extracts only 30% of coffee's aroma and flavor—the rest ends up as grounds. But what if you could taste 100% of the coffee? Mokable founder Akinori Itoyama, who spent over a decade in coffee R&D at Suntory, uses micro-grinding technology to turn roasted beans into ultra-fine powder, blend it with oils, and fully preserve the bean's aroma and flavor—transforming coffee into an edible ingredient.

(Source: Mokable)

Based on Mordor Intelligence projections, the AI market in the food and beverage sector is expected to reach USD 29.94 billion by 2026, with a compound annual growth rate (CAGR) exceeding 45.8%. With AI, sensory analysis is no longer limited to subjective evaluation. It can accelerate product development, shorten innovation cycles, and improve the accuracy of predicting consumer acceptance. From E-Nose and E-Tongue to deep learning, and neurophysiological technologies, this session explores the latest AI-driven sensory analysis tools.

Diverse flavors have become the core driver of winning consumers' taste buds. From cross-category mashups to niche ingredients and the global reinterpretation of local cultures, new ideas keep emerging. But how can brands identify which trends are truly worth investing in? Drawing on the latest global snack innovations, this session will decode the 2025–2026 flavor landscape, and explore following questions. How to spot the next big flavor? Which ingredient innovations truly resonate with consumers? And how to balance regional preferences in global R&D strategies? The answers will help make innovation investments more forward-looking and efficient.

Want to taste specialties from across Japan? Just visit a supermarket and pick up Koikeya's "Pride" chips. From Kobe beef and Kyoto yuzu to Kyushu seaweed soy sauce and Kumamoto grilled meat, Koikeya transforms iconic dishes into layered, flavor-rich snacks using local potatoes and corn. With a commitment to Japanese ingredients and meticulous flavor crafting, the brand reached ¥59.38 billion in consolidated sales in FY2025. How does Koikeya engineer taste? From flavor selection and ingredient sourcing to precise formulation—this is how chips rivaling real cuisine are born.

(Source: Koikeya)

Well-known regional ingredients such as Dandong strawberries, Lipu taro, and Wuchang rice have become popular choices in snack and bakery development, thanks to their consistent quality and strong origin recognition. For R&D teams, these ingredients offer distinctive flavor profiles and built-in quality credentials; for brands, the stories behind their origins, local food cultures, and craftsmanship provide rich material for communication and differentiation. This session combines expert insights, product showcases, and guided tastings to explore how regional ingredients create value in product innovation. Through real-world cases, speakers will break down practical approaches to leveraging origin, flavor, and storytelling - helping brands and R&D teams develop products innovative, credible, distinctive, and scalable.

AI is not just transforming data—it’s redefining how we understand the human body. What once seemed impossible in precision nutrition—decoding the complex interplay of genes, biomarkers, and metabolism—is now within reach.

Pioneers like Viome Life Sciences (AI + RNA, $175M funded) are proving the power of intelligent nutrition, using RNA sequencing to detect early health risks and deliver personalized dietary solutions that have clinically reduced IBS symptoms by 58% and anxiety by 31%.

In this new era, AI becomes more than a tool—it’s the nutritionist’s “cyber colleague,” bridging science and human vitality in ways never before imagined.

For decades, the nutrition industry has been built on a model of standardized products and mass consumption, with functional foods and FMCG systems driving scale through ingredients, formats, and branding. Today, that model is being fundamentally reshaped.

Rising demand for chronic disease management, increasingly sophisticated consumers, and the rapid advancement of data, digital health, and AI technologies are accelerating a shift from “one-size-fits-all” nutrition toward personalized, data-driven health solutions. Nutrition is no longer just about products—it is evolving into integrated systems that combine assessment, data, intervention, and ongoing health management.

“Let food be thy medicine,” the timeless principle of Hippocrates, the father of Western medicine, has shaped Europe’s approach to daily self-care for centuries. Elderberry anthocyanins, a flagship ingredient within this food-as-medicine tradition, have long been used to support the body through seasonal changes and everyday health maintenance.

In November 2025, elderberry anthocyanins were officially approved as a new food ingredient in China, marking the beginning of their legitimate application in the domestic functional food market and opening new opportunities for immune health and cross-category innovation. In the European and U.S. markets, elderberry has already established itself as a top-selling immune-support ingredient, backed by scientific research and consumer recognition. Its polyphenols also modulate gut microbiota, offering “non-traditional prebiotic” potential, extending its benefits from seasonal immune support to daily health management.

Tonic and food-as-medicine products have long been seen as high-barrier, low-frequency offerings for a niche group of informed consumers. Leveraging Hema’s retail ecosystem, supply chain capabilities, and data-driven insights, 「Hebubu」 applies modern FMCG logic to reframe traditional tonics into everyday, easy-to-use functional foods. This shift is helping move the category from an elite niche into everyday life—and redefining how tonic and functional foods can scale for the mass market.

By the end of 2024, China’s population aged 60 and above had reached 310 million, marking the silver economy’s entry into an unprecedented golden era. Unlike the past, when the focus was primarily on extending lifespan, today’s consumers aspire to “not just live longer, but live better.” Under the concept of active aging, the silver economy’s audience is expanding to younger groups who value functional health, quality of life, and emotional fulfillment.

This shift not only represents a vast opportunity for the health and elderly care industries, but also signals the continuous emergence of new products, services, and lifestyle scenarios.

Cellular health is the cornerstone of longevity science, and mitochondrial decline—as the cell's energy hub—is one of the core hallmarks of aging. As nutritional intervention enters the molecular era, bypassing biological barriers to achieve precision intervention for specific organelles has become the key to extending healthspan.

What are the core mechanisms of mitochondrial targeting technology? How can scientific innovation be transformed into tangible consumer value? These are the essential questions that brands and products must answer in this new era of cellular health.

As sports nutrition evolves from simple “supplementation” to science-driven performance intervention, M-ACTION is pioneering a systematic R&D approach that fills a critical gap in China’s professional sports nutrition market. Grounded in energy-metabolism mechanisms, diverse training scenarios, and empirical data from professional athletes, M-ACTION has built a comprehensive development framework covering ingredient selection, efficacy validation, scenario-based product design, and performance evaluation.

This session will explore how M-ACTION transforms scientific research into practical solutions that enhance athletic performance, accelerate recovery, and optimize energy utilization. It will also examine future innovation pathways for China’s sports nutrition landscape.

Creatine’s global rise illustrates how a niche functional ingredient can break out: originally focused on fitness and sports nutrition, it gained mass awareness through viral social media, especially TikTok, boosting category sales and brand penetration.

According to SPINS data for the 52 weeks ending December 29, 2024, total creatine supplement sales in the US reached $378 million, representing a 22% CAGR from 2023–2024, with gummies being the standout growing at 360% YOY $ growth.

In the probiotic world, Akkermansia muciniphila (AKK) has emerged as a hot “dark horse.” Beyond supporting gut barrier integrity and immune regulation, it shows transformative effects on metabolic health, weight management, and inflammation control. Multiple studies link AKK directly to reduced obesity and diabetes risk, earning it recognition as a next-generation probiotic.

On June 26, 2025, Danone made a major investment to acquire Belgium’s The Akkermansia Company, fast-tracking the commercial rollout of this star strain. From premium functional yogurts to precision nutrition packs and future personalized health solutions, AKK is moving from research papers straight into consumers’ carts. This represents not only a convergence of scientific innovation and capital strategy but also a potential starting point for the next wave of global gut health market growth.

With fragmented information and complex behavior, capturing true brand insights is harder than ever. Surveys often say “health first,” yet real choices show “price and taste first,” leading to misjudgments.

In the face of a reality where data is accurate, behaviors are fragmented, and motivations remain hidden, how can brands reconstruct their insight framework? By integrating results, behaviors, and psychology, how can brands identify false needs and uncover underlying motivations, reconnect with human nature, and ultimately strengthen decision-making capability and ROI?

As consumer choices spread across multiple platforms and usage scenarios, surface-level data often delivers conflicting signals, obscuring real needs. From zero-sugar sparkling water and electrolyte drinks to iced tea and Zizai Water, many of Chi Forest’s key decisions were made before clear market consensus emerged. These choices were supported by a strong ability to interpret real usage contexts and psychological drivers.

This session explores how Chi Forest looks beyond fragmented behaviors to understand real consumers—and turn insight into sustainable product innovation and growth.

Data can show what consumers click or buy, but it does not guarantee trust or cultural resonance. In the emotion-driven food and beverage industry, people seek not just products but also lifestyles and identities.

KitKat, though a British chocolate, built a unique path in Japan by linking its name to Kitto Katsu (“sure to win”), becoming a good-luck charm during exams. With gift boxes, regional editions, seasonal specials, and 400+ flavors, it evolved into both a collectible and a cultural symbol woven into daily rituals.

This raises key questions: How can brands identify and amplify cultural touchpoints? How can cultural meaning be translated into products and content? And how can they avoid missteps while building lasting cultural resonance?

(Source: KitKat Japan)

Kraft Heinz North America’s CMO notes that in today’s flood of information, consumers feel emotionally detached. To stand out, brands must act as a “harbor” offering stability and hope. The competition ahead is less about function or price, and more about who can win emotional resonance.

Saturnbird’s coffee capsules are photographed and shared as lifestyle symbols; Coca-Cola’s “Share a Coke” bottles spark identity recognition through names; Ben & Jerry’s ties consumption to values like peace and sustainability.

So, how can brands use visual language, content, and values to move beyond features, forging emotional bonds that shift users from simply “choosing” to truly “identifying” with the brand?

In today’s world, consumers are emotionally nuanced and highly perceptive, making authenticity a crucial driver of long-term trust. How can brands translate authenticity into creativity and commerce, moving from emotional resonance to rational conversion?

Grey’s two standout campaigns provide clear answers:

- Corona Cero – For Every Golden Moment: Expanded Olympic “golden moments” into daily life, inspiring authentic relaxation and celebration, and delivering triple-digit growth in 2024.

- Stella Artois Advertising Series: Captured desires for order, calm, and quality through poetic visuals, winning 9 Cannes Lions and turning emotional resonance into stronger perception, premium, and loyalty.

(Image source: Grey)

In today’s fast-moving marketplace—defined by traffic anxiety, fragmented channels, and an endless cycle of new product launches—many food and beverage brands have fallen into the trap of chasing short-term “hits,” often at the cost of long-term strategy. For CMOs, growth has become an art of balance: between sales KPIs and brand equity, speed and sustainability, conversion and connection.

When short-term performance meets the need for long-term brand building, how can CMOs stay focused and strategic amid constant change? How do we balance product innovation, marketing investment, consumer relationships, and brand storytelling—so that every action not only drives immediate growth but also deepens enduring brand value?

In China, many people have been drawn to that “big-sized dumpling” — bibigo. Originating from Korea and first launched in the United States, bibigo has since gone global to become the world’s No.1 dumpling brand. From Korean kitchens to American supermarkets, from Eastern flavor to global dining tables, how did bibigo craft a brand strategy and cultural narrative that transcends borders and wins over consumers worldwide? And in China, the most competitive dumpling market, how did it stand out and win local hearts?

(Source: bibigo)

Chick-fil-A, the U.S. fried chicken chain that spends little on advertising, generated $22.7B in 2024 with over 30% of the chicken QSR market and has topped the ACSI satisfaction index for 11 consecutive years. Unlike rivals expanding across categories, it has stayed focused on chicken sandwiches, winning loyalty through “experience equity.” From warm service and thoughtful drive-thru or table interactions, to the signature “My pleasure” and even family-oriented streaming content, every touchpoint conveys care and respect. By fostering emotional belonging through consistent experiences, Chick-fil-A drives repeat choice and advocacy. Could experiential marketing be the foundation of sustained growth—and how can other brands define their own?

Biscoff has never sought the spotlight in coffee, yet with 93 years of focus on one caramel-cinnamon flavor, it has become the global default in coffee moments.

Positioned as a “supporting role,” it built lead-brand recognition and premium equity—not through constant innovation, but through mastery of a single product. That flavor transcended categories, extending into ice cream, cakes, mooncakes, and spreads, even deepening memory when absent elsewhere. By anchoring itself in high-emotion occasions—cafés, airplanes, festive baking—and leveraging crossovers, Biscoff has bound its brand to a “familiar comfort.”

In a world of fast-fading fads, how does Biscoff turn a single product into global penetration—and how can a “supporting role” accumulate enduring value?

With traffic plateauing and decision paths lengthening, brands often see exposure without conversion. Success lies not in visibility but in presence within the right scenario: usage defines value, consumption builds memory, and transaction triggers action. In Chongqing–Chengdu Lawson stores, Bushuaila turned outlets “brand blue” to echo Lawson, linking post-heat hydration, immersive cooling, and shelf placement to drive instant conversion. How can brands design such scenario loops so every encounter feels natural, precise, and seamlessly part of daily life?

In the era of short video and social media, content is the main battlefield for brand growth. Yet many still follow the old “produce, post, wait” logic, resulting in short-lived, low-efficiency work. An effective system should be productized—modular, multi-platform, and reusable.

Coca-Cola’s Share a Coke created a global template; McDonald’s built modular “Hash Brown at Breakfast” assets; Saturnbird unified its story under “Sustainable Coffee Living”; Eastroc activated modules like “hard work” and “late-night hustle.” Each turned content into repeatable growth assets—extending lifecycle, broadening reach, maximizing ROI.

In a culture chasing virality, how can brands build a sustainable content system that transforms one idea into a long-term, reusable asset?

As young consumers embrace “light tipsiness,” huangjiu’s share has dropped below 2%, still tied to “health culture.” Kuaijishan broke the ceiling with its sparkling huangjiu One Day, One Buzz, positioned as a “Chinese beer” for low-alcohol, trendy tastes. During 618, it topped Douyin and sold 100x more than all rivals combined, boosting market cap from RMB 5B to 12B. As the face of a new drinking mindset, how can insights, innovation, scenarios, and organizational alignment fuel a youth-oriented growth flywheel?

McKinsey notes a common challenge for global CEOs: abundant data, little monetization. Despite heavy investment in data warehouses and analytics, one-third of executives believe value remains untapped. The food and beverage sector is even more constrained—over 90% of its data is unstructured social content, with fragmented touchpoints and broken journeys limiting actionable insight.

True digital transformation lies in breaking silos, improving usability, and enabling data-driven growth. McKinsey projects that within five years, 22% of brand managers’ daily tasks could be automated, boosting marketing strategy efficiency by 10% and monitoring efficiency by 40%.

This session will explore: How can brands advance data structuring, unlock value across collection, integration, and execution, and eliminate “data islands” to pave the way for AI and digital adoption?

AI in F&B has moved from trials to scale. Leaders show gains in R&D, supply and personalization, yet many, esp. SMEs, still struggle to execute.

○ Where are AI’s real capability limits? Which tasks are better for humans, and which should be handled by AI?

○ How should F&B brands of different sizes determine the right level of AI adoption?

○ Beyond R&D, supply, marketing, packaging, what else can AI improve?

○ How can AI develop “empathy” and deliver greater value by better understanding and caring for people?

Singapore has long been a key innovation and regional decision-making hub for leading global food and beverage companies such as Nestlé, Mondelēz, and PepsiCo. As AI becomes a core enterprise capability, Singapore has also emerged as an important global AI hub, with NVIDIA establishing its global AI technology center network headquarters there, and Heineken locating its first AI lab in Singapore.

This development is supported by Singapore’s long-term approach to AI talent capability building since 2017, led by AI Singapore, the national AI strategy and industry transformation initiative.

In marketing, the challenge has shifted from whether to use AI to how AI capabilities are acquired, embedded, and sustained within organizations. Many teams still rely on tools, external agencies, or a few individuals, making AI difficult to institutionalize.

In this session, Sengmeng, Director of AI Talent Development at AI Singapore and a member of the Office of the Senior Deputy President (Research & Technology) at the National University of Singapore, will share Singapore’s journey. He has worked extensively on national AI capability and capacity building, involved in global AI standards development (ISO, IEEE), and professionalising industry AI roles with sectoral champions such as Chartered AI Engineer and Certified AI Practitioners.

The session will focus on key questions for marketing leaders:

- Which AI capabilities should be built in-house for the long term?

- How can AI capabilities move from individual expertise to organizational capability?

- How can clear capability standards and talent structures turn AI investment into business value?

As customer journeys lengthen and decisions grow more complex, brand growth has shifted from single-point wins to full-chain coordination. From consumer insights and content creation to media, conversion, and loyalty activation, AI is increasingly embedded in every critical touchpoint, enabling brands to move from intuition-led decisions toward a more data-driven, measurable growth system.

Across these key moments, how can brands ensure that strategy and judgment remain human-led, while allowing AI to become a powerful collaborator that amplifies insight, sharpens decision-making, and strengthens execution?

With consumer segmentation accelerating, the target audiences for food and beverage brands are more diverse than ever—spanning generations, lifestyles, and value systems, with increasingly refined demands. Against this backdrop, how can packaging precisely resonate with the aesthetics and value orientations of distinct consumer segments? In the instant interplay between rational choice and emotional impulse, how can brands compel different groups to pause and engage? Grounded in consumer insight, brands can systematize color, structure, and cultural codes to build packaging strategies tailored to varied demographics and consumption contexts.

Ten years ago, American Design Management Institute launched a decade-long study on the relationship between design and business performance. The results revealed a striking insight: design-driven companies such as Apple and Nike outperformed the S&P average by 211%. Design, therefore, is not just about aesthetics. It’s a form of productivity. Through real data and brand case studies, this session will uncover how integrating design into business strategy can transform creativity into brand momentum and sustained growth.

Research shows that purchase decisions made in front of the shelf are rarely the result of rational analysis. In fact, within just 0.3 seconds, the brain forms a subconscious judgment. Color, shape, material, and the way information is presented all influence how consumers instinctively perceive taste, quality, and trust.

This session explores packaging design through the lens of neuroscience, revealing how the brain processes visual cues, forms instant impressions, and drives purchase behavior at first glance. By analyzing popular packaging cases on the market, it uncovers what they get right at a perceptual level, while also highlighting "counter-intuitive" design pitfalls that can trigger instinctive resistance. Through this training, brand and design teams will learn how to communicate taste and value more effectively, making packaging work harder with less effort.

Nestlé is harnessing digital packaging to balance speed, cost, and personalization. Through digital twin technology, it builds 3D packaging models that can be instantly adapted for markets and campaigns, cutting photo-shoot costs and accelerating product launches. By 2027, Nestlé plans to create over 10,000 such models. Meanwhile, AI-powered QR codes transform packaging into an interactive gateway, delivering personalized recipes, product recommendations, and traceability. Packaging is no longer static—it becomes a dynamic interface between brand and consumer, and a new digital touchpoint for retailers.

According to the 2025 Emotional Consumption Trend Report, China's emotional consumption market is expected to surpass RMB 2 trillion by 2025. Consumers are no longer satisfied with material ownership alone—they seek self-expression, emotional resonance, and a sense of connection, and are willing to pay for experiences that bring joy and recognition. This shift is also shaping packaging design. From IP collaborations and dopamine-inspired color palettes to cultural motifs and traditional crafts, packaging now adds playfulness and emotional layers to everyday eating and drinking.

McDonald's TableToGo turns the inconvenience of eating on the go into a playful interaction: with a simple fold, a stable table can be set up on roadside poles for a comfortable dining experience anywhere. Packaging shifts from mere container to functional tool, enhancing the mealtime moment. The concept boosted sales during Milan Fashion Week, went viral on social media, and won a 2024 D&AD Award. Starting from TableToGo, this session explores how interactive packaging can balance function and fun while generating lasting commercial value.

(Image source: Leo Burnett)

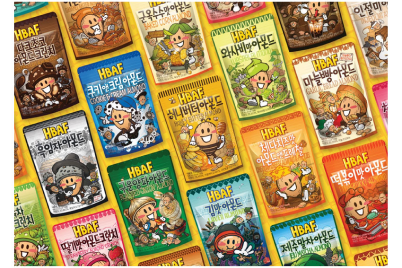

Make the product the main character, give it expressions and a setting, and hide a "tiny" bit of detail, then illustration can bring food to life. From HBAF nuts to SAJO’s 365.24 series, Korean designer Jung Eun captures brand personality through her human-touch illustration style. Within these cartoon figures, you can almost see the flavor, ingredients, even the making and eating process of the food itself.

(Source: HBAF)

In today's crowded shelves and visual overload, it has become increasingly difficult for brands to leave an instant impression. To overcome "visual fatigue," beverage brands like Minute Maid and other brands have introduced scented packaging with prompts such as "rub to smell." A burst of fruity or floral aroma matching the flavor delivers a moment of delight that embeds itself in consumers' sensory memory.

From scent selection to interactive cues, from shelf engagement to social sharing, this session explores how packaging transforms fragrance into a golden touchpoint that drives purchase, connection, and repeat sales.

Food is a natural bridge between cultures. Regional flavors, local ingredients, and craftsmanship inspire brands to tell cultural stories through packaging. Designers translate these influences into typography, color, and form, while brands explore shapes and materials to make culture tangible. From purchase to use, consumers can feel the warmth of culture and the soul of the brand in every detail.

Since its launch in 1971, Nissin Cup Noodles has sold over 50 billion units worldwide and generated $5.04 billion in revenue in 2023. Its packaging strategy combines series consistency with high recognition: a unified cup shape, logo placement, and core visual layout ensure instant shelf identification, while color coding, illustrations, and playful elements differentiate flavors and inject freshness. From localized designs reflecting cultural tastes to limited editions, Cup Noodles has evolved into a collectible icon. This session unpacks Nissin's design framework, showing how systematic yet creative packaging can deliver both global recognition and emotional engagement across diverse consumer groups.

(Image source: Nissin)

In membership-based retail like Walmart and Sam's Club, Retail Ready Packaging (RRP) and Products Display Quickly (PDQ) are standard. Growing twice as fast as conventional formats, they follow the "5 Easy" principles: easy to identify, open, shelf, shop, and dispose—streamlining stocking while boosting sales. This session explores why shelf-ready design is favored in global retail, what structural and informational elements matter most, and how RRP/PDQ packaging satisfies logistics, display, and marketing needs at once.

Between 2022 and 2024, the share of innovative private-label products grew from 11% to 26%, making it the fastest-growing segment worldwide. From Sam's Club, Costco, and Aldi to Freshippo and Pangdonglai, retailers are rapidly building their own private-label portfolios. This session explores how packaging—through both materials and visual design—can help retailers establish private labels as trustworthy, recognizable, and competitive brand systems.

As the food and beverage industry enters a phase of faster product cycles and increasingly fragmented categories, the challenge for companies is no longer simply how to make products, but how to consistently deliver different products well within shorter timelines.

On the production side, a growing number of SKUs and faster flavor iterations are putting higher demands on line changeover efficiency and operational stability. In packaging, new structures and materials continue to emerge, yet significant communication gaps still exist between design and mass production. Downstream, logistics efficiency, palletization methods, and on-shelf presentation are now directly influencing cost control and in-store performance.

This roundtable brings together smart packaging equipment providers and food and beverage brand leaders to re-examine how the entire value chain can work more collaboratively. The discussion will focus on three critical stages:

1. Food Production: As product specifications continue to change, how can production lines improve efficiency while maintaining consistent quality?

2. Packaging Solutions: With rapid innovation in packaging formats, how can equipment providers get involved earlier in R&D to reduce repeated adjustments between design and scale-up?

3. Logistics & Shelf Management: From factory to shelf, how can intelligent equipment help reduce loss, improve circulation efficiency, and adapt to the needs of different sales channels?

Through a small-scale, high-density, problem-driven discussion, FBIF aims to bring technological innovation back into real production and operational scenarios—encouraging earlier collaboration between brands and upstream partners, and jointly exploring long-term solutions that balance speed and quality in the food and beverage industry.

Today, we discuss assortment strategy not because consumption is moving in a single direction, but because multiple consumption logics now coexist. In this environment, the core challenge for retail is no longer identifying trends, but building a coherent decision-making framework that remains intact amid layered and parallel realities.

In the past, information asymmetry and limited choice meant that channels themselves represented value, and consumers cared primarily about where to buy. Today, however, quality products are abundant, homogenization happens at speed, prices are highly transparent, and comparisons are effortless. Choice, rather than empowerment, has become a burden. What consumers truly lack is no longer products or information, but something more fundamental: whom they can trust.

In today’s consumption landscape, retail channels must be built and managed much like brands. They are no longer merely venues for transactions, but entities that establish trust in consumers’ minds through consistent assortment judgment, a coherent value orientation, and experiences that can be repeatedly validated. It is this sustained clarity that enables retailers to form a credible and resilient brand presence.

FamilyMart has been operating in mainland China for 20 years, with nearly 3,000 stores, more than 85% of which are franchised. If viewed through the traditional lens of a “curator-style” merchandiser, FamilyMart may not appear particularly “trendy”: it does not aggressively chase frontier hit products, nor does it emphasize a strong personal aesthetic. Yet this perception misses the point. FamilyMart’s strength in assortment lies not in creating single blockbuster items, but in stability, structure, and the ability to make high-frequency decisions day after day.

Operating under the realities of high-frequency consumption, low average transaction value, and strong franchise constraints, FamilyMart is not simply selecting products. Through assortment, it builds a daily life system that consumers can trust and rely on—from breakfast to late-night meals, from efficiency to emotional comfort.

Starting from the concept of “a day in life,” this session explores how FamilyMart uses time-slot segmentation, scenario-based assortment, and membership data to reverse-engineer its product structure, continuously optimizing the consumer experience at scale. It ultimately addresses a core question: when 85% of stores are franchised, for whom—and for which moment, and which life state—should the merchandiser truly be making decisions?

Central Retail is Thailand’s second-largest retail group, second only to CP ALL, with operations spanning multiple markets across Asia and Europe. In 2023, Central Retail reported global revenue of THB 253.015 billion, sustaining steady growth. In its domestic market, Central Retail’s supermarket portfolio under the Tops brand has developed a multi-tiered retail ecosystem ranging from community-based formats to high-end specialty stores, including Tops Daily, Tops Market, Tops Food Hall, and Tops Fine Food, designed to serve consumers across different income levels and lifestyle needs.

Within such a highly diversified retail system—where formats are layered and consumer segments are clearly differentiated—the challenge of assortment planning goes far beyond selecting the right products for individual stores. Instead, it becomes a question of how to build an assortment system that delivers clear differentiation across price tiers, purchase frequencies, and aesthetic expectations, while maintaining internal coherence and consistency at the group level.

When the same retail group must simultaneously support highly routine, community-based consumption and cater to premium consumers who are acutely sensitive to quality, flavor, and aesthetics, how should assortment standards be defined? Which decisions should vary by format, and which principles must remain unified across the organization? In a multi-format retail group, is the role of the assortment leader primarily to allocate products—or to design the underlying decision framework?

Drawing on Central Retail’s practical experience in operating multiple formats in parallel, this session explores how assortment systems can avoid fragmentation within complex retail structures. It further examines how the role, capabilities, and decision boundaries of assortment leaders evolve in multi-tier retail ecosystems, and what insights this experience may offer to other markets and retail models.

In an era of information overload, any food safety incident can be instantly amplified. The rate at which trust is eroded far outpaces a company’s ability to restore it.

Therefore, a robust, stable, and flexibly responsive production and supply system has become the most critical foundational capability for retailers and brands.

In the Chinese market, high-quality retail has long relied on a relatively stable premise: premium products carried inherent consensus, discerning consumers would naturally gravitate toward them, and buyers’ judgments were automatically recognized as valuable. However, this premise is shifting. Post-pandemic, core customer segments have fragmented and some have been lost, while consumption patterns and lifestyles have changed significantly. At the same time, limited online channel capabilities have further widened the communication gap between high-quality retail and the new generation of consumers.

Against this backdrop, buyer-led retail—centered on judgment and professional expertise—is now facing more complex challenges in scaling operations, including cash efficiency, organizational governance, and supplier collaboration models. For city’super, the question is no longer simply how to continuously select “great products,” but how to rebuild retail relationships that are understood, chosen, and trusted over the long term, in an environment of shifting customer segments and operational constraints. This evolution requires the buyer system to upgrade from a single product-selection mechanism to a structured, organization-supported, system-managed, and supplier-collaborative model.

This session will share city’super’s recent adjustments in the Chinese market and discuss the core challenges facing buyer-led retail today, including restructuring organizational systems, balancing buyer judgment with cash management, transforming supplier relationships from transactional to collaborative, and reestablishing effective communication with target consumer segments in the new consumption landscape.

Within a highly scaled platform like JD, data, efficiency, and supply chain capabilities form the core strengths of developing own-brand products. However, in food—a category highly dependent on intuitive judgment and long-term accumulation—does systematization and scale introduce new constraints? This session will draw from JD’s own-brand experience to discuss which capabilities become harder to maintain as the platform scales, and how these challenges influence long-term decisions in food selection and innovation.

Key discussion points:

- Amid massive amounts of data, which signals are actually unreliable? Among metrics like search, clicks, conversion, and repurchase, which are short-term noise and not suitable to directly guide new products?

- When data consistently points toward “faster, cheaper, more homogenous,” how does the platform preserve long-term product direction?

- In “slow-variable” categories like food, should data lead or lag decision-making? Which food trends inherently show delayed signals? How does JD capture shifts in sentiment, health, and culture ahead of the data curve? Is data more suited for discovery or validation in food selection?

- As platform scale increases, which capabilities paradoxically become more difficult? Food innovation often requires small-batch, multi-round experimentation with unstable outcomes, whereas JD’s system is designed for predictable quality and large-scale replication. Where does JD insist on maintaining scale, and where does it intentionally sacrifice scale to preserve diversity?

The fresh food e-commerce sector is fiercely competitive, and Dingdong Fresh’s track record speaks for itself. In the high-stakes, fast-changing dark store landscape, Dingdong Fresh has survived not through aggressive expansion, but by gradually transforming product operations into a measurable, verifiable digital system. Today, Dingdong operates over 1,000 dark stores nationwide, with each store managing an average of around 4,000 SKUs. Every 24 hours, the system forecasts demand for all SKUs across all locations, directly driving procurement, production, and allocation decisions. By the end of 2023, roughly 90% of dark store procurement is automatically completed by the system. Even under complex conditions such as extreme weather, forecast accuracy remains above 85%, while overall loss rates are consistently controlled between 1%–2%. At this scale and complexity, product selection is no longer a matter of experiential judgment—it has become an engineering problem that requires continuous calculation and calibration by the system.

This session will focus on three core questions:

How digital systems reshape product selection granularity and rhythm — From launch and testing to delisting, how selection is converted into a fast-fail, continuously iterated mechanism.

SKU management as a structural, not just numerical issue — How the system dynamically calibrates SKU structures across cities and stores to balance volume, average order value, repurchase, and gross margin.

How digitalization truly supports private-label and differentiated product development — Which data points define “worthy-to-develop” products, and how innovation failure costs and risks are controlled.

Chris is one of the few leaders who has completed the full journey from frontline buyer to group CEO. Before stepping into the CEO role, he spent years at the very front line of merchandise decisions, personally making countless judgments on whether a product should be listed. As his role shifted toward group management and corporate leadership, the challenge he faced was no longer the success of a single product, but how to enable the organization to continue making sound product decisions over the long term.

In this session, Chris will draw on his experience transitioning from an individual decision-maker to an organizational leader, sharing how he transformed experience- and intuition-driven personal judgment into organizational capabilities that can be replicated and continuously calibrated. He will also explore how retail companies should make trade-offs between speed, scale, and long-term value while pursuing differentiation and breakout products.

This is not a methodology-focused talk on “how to create bestsellers,” but a discussion on how judgment can be embedded into systems—and amplified sustainably within an organization.

At the recently announced 2026 Superior Taste Award, eight core products from Maizhenxuan stood out. Two received the highest distinction of Three Stars for Exceptional Taste, while several others were awarded Two Stars for Remarkable Taste and One Star for Notable Quality.

What impressed us about Alex is his consistent belief that products are something worth taking seriously. In his work, products are not vehicles for KPIs, but a series of questions that must be asked again and again: What does “truly delicious” mean? What kind of health actually matters? Which flavors are worth standing by, and which choices—though seemingly correct—lack a soul and should be rejected? These judgments do not stop at philosophy; they are embedded in everyday practices of assortment decisions, product choices, and organizational collaboration.

What Alex represents is not a formula for quickly replicating bestsellers, but a product value system that is becoming increasingly rare in the industry—one that builds standards of judgment from personal taste, drives organizational decisions from real experience, and preserves the dignity of the product itself even under pressure from cost and efficiency. This devotion to product is not loud, but it is enduring and consistent.

When product judgment is already in place, who carries it through the final mile to being truly seen?

Strawberry box cakes, HPP red apple juice, and lime juice—though seemingly from different categories—share a highly similar journey: from hyped blockbusters to consistently chosen long-term bestsellers.

By dissecting these products, we find that those capable of outlasting the hype cycle rarely rely on continuous buzz. Instead, they achieve the shift from “being noticed” to “being needed” through solid taste, frequent use, appropriate price positioning, and consistent user experience.

This discussion seeks to answer a question more crucial for all brand and product leaders:

After the hype fades, which products are truly worth sustaining for the long term?

Based on long-term sales data analysis of nearly 600,000 SKUs and a study of product structures that continue to be chosen even after their initial hype, we are attempting something rarely done in the industry—not to predict trends, but to provide informed judgment.

In this session, we will unveil several “Potential Product Concept Works” for 2026–2027. These are not ready-to-market products, but systematic projections of future product forms, usage scenarios, and consumer motivations based on common traits shared by long-lasting bestsellers.

These concept works illustrate the directions most likely to endure the hype cycle if product development starts seriously today.

The choice of purchase channels is deeply intertwined with consumers' lifestyles, while preferences for specific sub-categories reflect the distinct characteristics of different consumer groups. By tracing these signals back from daily consumption habits, we can map purchase scenarios, build a connected insights network, and uncover growth opportunities.

Navigating a complex market? FBIF delivers actionable, full-chain insight:

Grounding in the People-Goods-Scene framework, we clarify China's consumer landscape—helping you identify what's next in a fast-changing market.

As the symbolic "second entrepreneurship" of Master Kong, the "TeBieTe" Fresh Noodle—nine years in the making—became an immediate breakthrough for the long-established giant. With technical innovation that delivers a new level of freshness, a bold premium repositioning, and a viral integrated marketing push, the product sold 3.444 million bowls within three months.

At the same time, Master Kong's broader innovation pipeline is accelerating—from premium upgrades and regional flavors to broth restoration, real-ingredient authenticity, and new consumption scenarios. "TeBieTe" marks not only a redefinition of instant noodle value, but also the beginning of how legacy food giants can evolve toward the next era of eating experiences.

Many star products from e-commerce platforms fall victim to the "internet celebrity curse": once enjoying online benefits, they often plateau when entering offline markets, eventually declining as brand momentum fades.

1. From Online Brand to Omnichannel Brand: How did they break through new channel plateaus to achieve cross-boundary growth?

2. From Bestseller to Product Portfolio: How did product innovation strengthen their business model, ensuring long-term brand competitiveness?

Since listing in 2015, HBAF (silent "H") became a leading nut brand in South Korea, with its flavored almonds sold in 25 countries. The honey butter flavor alone has sold 200 million packs. In 2024, annual sales reached 109.2 billion KRW (about 565 million RMB). From a 10 billion debt-ridden distributor to a category innovator, how did HBAF succeed?

(Image source: HBAF)

Today, consumers' expectations go beyond just purchasing a good product; they want to see the brand values and lifestyle the product represents.

According to a joint survey by Rednote and Nielsen, 33% of buyers of emerging food and beverage brands purchase because they "identify with the brand's tone and values, feeling understood by the brand." The demand for "personalized" products also brings higher added value and user loyalty.

The Magnum Ice Cream Company—undoubtedly one of the most significant "emerging companies" of 2025. Just before the split from Unilever, TMICC launched Hydro: ICE, a dairy-free product that not only provides hydration but also delivers Vitamin C, Vitamin B2, and the electrolyte magnesium, while glowing in the dark.

—Why must an ice cream glow in the dark?

The answer to this question reveals the key to their commercial ambition. Product design is a crucial reflection of a company's strategy, and at TMICC, we can see many "bold ideas" that transcend traditional thinking.

In just two years, TangSanLiang, a startup brand, successfully attracted nearly 10 million yuan in angel investment from Challenjer Venture. The revolutionary business model created by TangSanLiang answers two key questions:

1. How can consumers enjoy a good drink at the lowest cost?

The charm of alcohol lies in its "basic need." By radically cutting all additional costs and focusing on the essence of "taste," the brand has reintegrated alcohol into daily life habits.

2. How can a liquor store be opened at the lowest cost?

By creating a warm, accessible consumer experience and offering popular products in small, community-focused gatherings, TangSanLiang has developed a retail model that is completely different from traditional liquor shops.

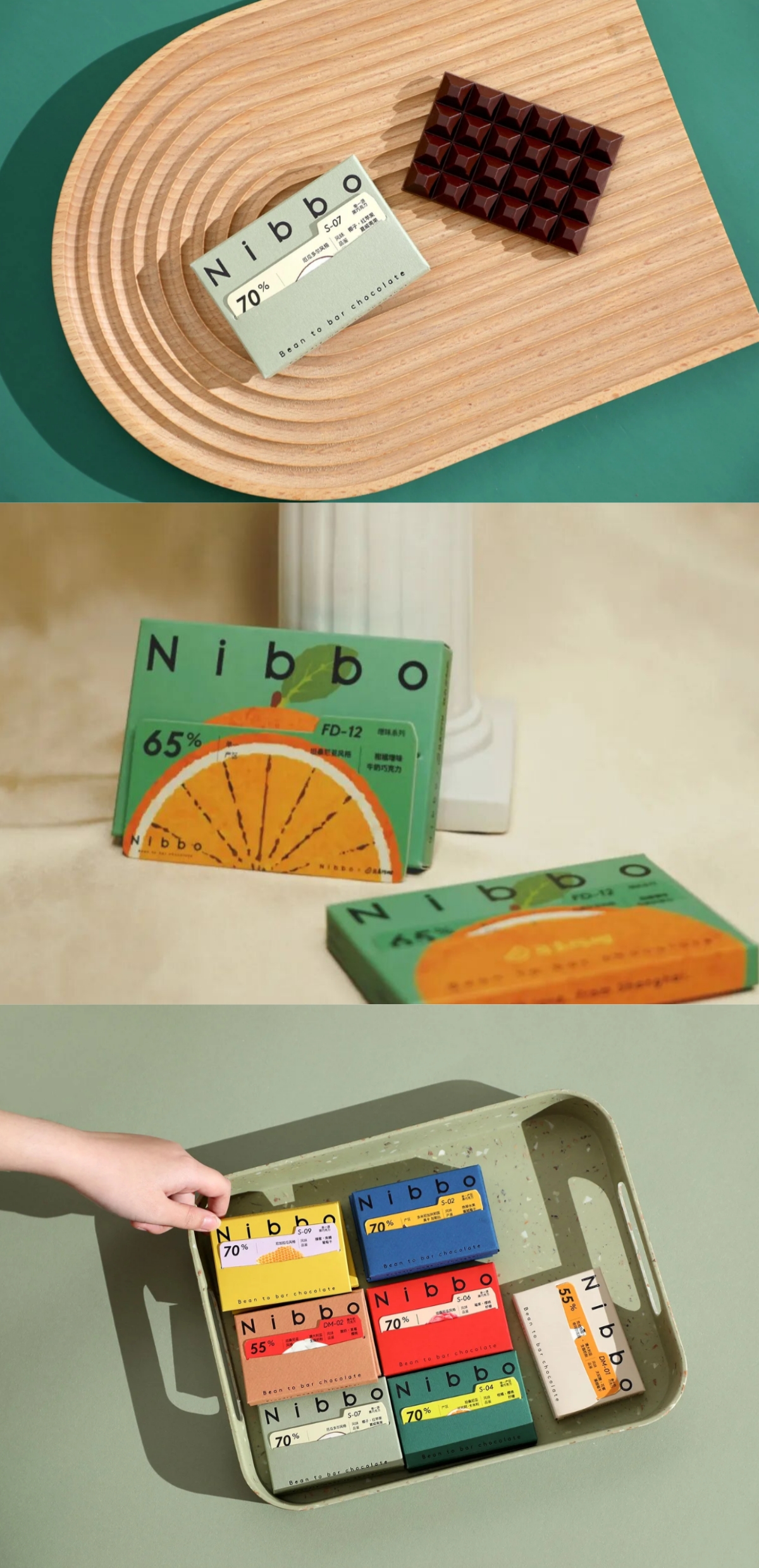

Nibbo, founded in Shanghai in 2019, is among China's earliest craft chocolate brands. Founder Fan has over a decade of fine-chocolate experience and previously ran a cacao studio in Australia, developing cacao products and sourcing exceptional flavors worldwide for Chinese consumers. In 2025, ten Nibbo bars won 25 awards at the International Chocolate Awards (ICA) World Final and Asia-Pacific competitions, often called the "Oscars of the cacao world."

Committed to Bean-to-Bar, Nibbo creates chocolates that integrate aroma, mouthfeel, texture, and flavor. FBIF invites you to taste its layered, lively single-origin cacao profiles on-site.

Beyond the accolades, Nibbo is advancing flavor innovation that connects global origins with cultural expression—using premium chocolate to evoke local memories. Despite rising popularity, the brand has chosen to slow down, balancing rigorous quality control with efficiency. Through a dual journey of "distinct origins" and "cultural flavors," Nibbo demonstrates how brands can strengthen a sustainable ecosystem via deep origin partnerships, collaborative innovation, and shared value creation. Having defined "China's craft chocolate," Nibbo now seeks to empower the industry, influence global markets, and continue shaping an Eastern flavor narrative.

(Source: Nibbo)

Consumer demand for "freshness" is continuously rising, with emerging categories like coconut water, fruit and vegetable juices, and iced cups gaining popularity. These categories, often characterized by high levels of homogeneity, have become a battleground for many companies.

As leading brands with stronger technology and supply chains enter the competition, how can smaller brands break through?

Many traditional food categories are widely available in households but lack a well-known brand. One major issue is that many brands appear outdated compared to modern aesthetics; a deeper problem lies in the lack of standardized production systems.

At the same time, the success of brands like YiMiBa, YanZhongTian, and GuoXiaoFan proves that consumers aren't rejecting traditional agricultural products, but rather seeking these products to evolve with the times.

How can we break the "overlooked" dilemma of traditional processed foods? From supply chain standardization to brand building, how can brands stand out in a chaotic, rapidly growing market and turn category pain points into brand opportunities?

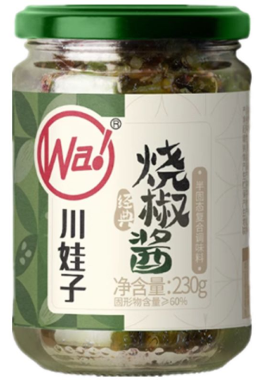

As regional flavors gain increasing popularity among consumers, ChuanWaZi has successfully unlocked a 1 billion market with its Sichuan chili sauce, becoming a model of explosive growth in the niche, "small but beautiful" segment. As early as 2018, ChuanWaZi began expanding into overseas markets, and its products are now sold in over 40 countries and regions, including North America, Europe, and Southeast Asia, becoming one of the world’s best-selling condiment brands.

The success of ChuanWaZi chili sauce offers valuable insights into the innovation and expansion of local flavor products:

· How to solidify product strength and strike a balance between regional flavour and mainstream taste?

· How to find sustainable growth breakthroughs through strengthening the supply chain and integrating multiple channels?

· How to build stronger market competitiveness through an interconnected industrial ecosystem?

(Image source: ChuanWaZi)

In 2025, the global nutritional supplements market reached $473.4 billion and is projected to grow to $888.66 billion by 2035. This rapid expansion reflects not only consumers' growing focus on health but also a shift in consumption patterns. Today, consumers' demand for health products is no longer limited to pharmaceuticals or traditional supplements; they are increasingly embracing nutritional supplements in the form of snacks and beverages. How can brands seize this trend to meet consumers' integrated needs for health, convenience, and enjoyment? How can they use innovative product design to break away from the "boring medicine" label, enhancing product appeal and market share?

The food and beverage industry is witnessing the rise of a new wave of 90s-born leaders. This panel invites several 90s-generation brand heads to share their perspectives on:

· Where do they see opportunities in the future consumer market?

· What are the changes and constants for food and beverage brands in the new era?

· How can innovative positioning lead industry trends?

Amidst a slowdown in the global alcohol market, the new drinks segment grew at 6.1% annually from 2015 to 2024. Innovative products, now over 5% of the sector, drove more than $100 billion in sales. This growth is fueled by a shift in young consumers' preferences toward low-ABV, health-focused, experiential, and occasion-based drinking.

Gaosheng Winery exemplifies this shift. Its value wine line leads in repurchases and store sales at Aldi. Co-developed with Hema, its "Goodnight Sip" became a top-selling and most-repurchased new product, sparking 4 million social media impressions. Innovations like mulled wine kits and cocktail packs further blend health with experience.

Through "Counter-Inertia Innovation," Gaosheng tackles two key challenges:

Moving Beyond Novelty: How to embed new drinks into real daily routines?

Reinventing Wine: How to make wine accessible beyond traditional perceptions and occasions?

The ACGN (Anime, Comics, Games and Novels) sector has become one of today’s most representative emerging economic fields, attracting countless brands and businesses. This community is known for its high enthusiasm and loyalty, with many willing to spend heavily on their favorite characters or works. There's even a self-deprecating saying: "The money in ACGN is the easiest to make (or trick)." This reflects the immense potential and business opportunities within the ACGN market.

In the world of ACGN economics, the premium attached to IPs and characters, along with massive traffic, makes this market highly attractive. For brands, the ACGN economy is not just a mysterious realm but a growth pool filled with vast opportunities and challenges.

Have you ever wondered what products today's young people truly love? What kind of creative sparks can emerge when young people’s unique ideas perfectly align with practical needs?

FBIF is the ideal stage for turning creativity into reality. We connect brands with rich resources and young innovators with fresh ideas to explore and lead the next wave of product and brand innovation, creating the next big creative trend!

This Next-gen F&B Innovation Challenge is open to university students. Shortlisted entries will have the opportunity to present their ideas at the FBIF 2026 Product Development Forum, where the most promising innovative proposals will be selected.